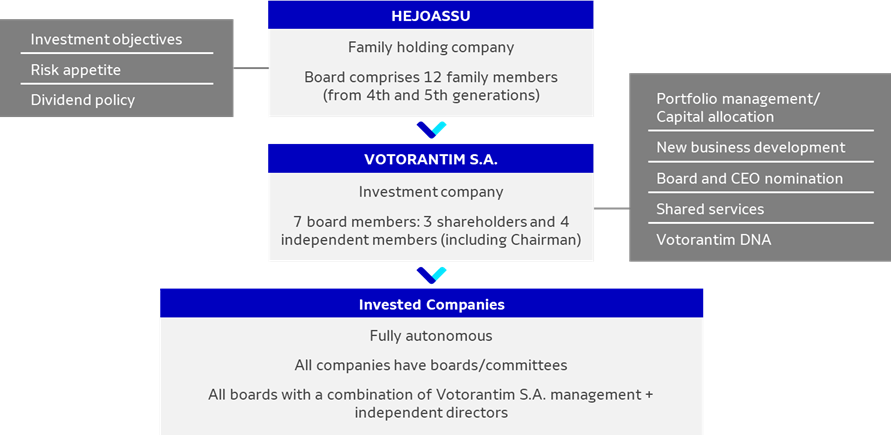

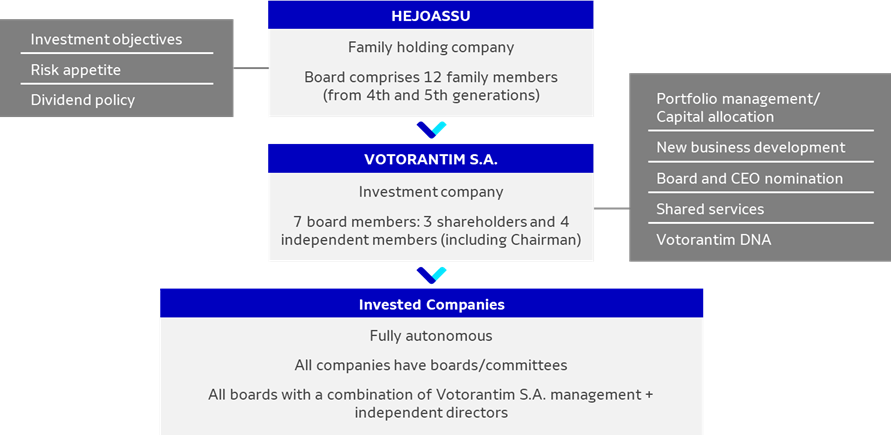

Votorantim is a real-world example of how long-term boards align company values with strategic vision. The company’s governance structure operates on three interconnected axes, represented by distinct but complementary bodies:

- Ownership – The Board of Hejoassu, Votorantim’s shareholder.

- Family – The shareholder family Board.

- Business – Votorantim S/A, led by two collaborative entities: the Board of Directors and the Management Teams of Votorantim and its portfolio companies.

A challenge Votorantim navigates is its positioning as a company based in a developing country while operating across developed markets. The company spans a diverse range of sectors, from investments to industry, and includes both recently established and century-old businesses. The objective is to align expectations and establish governance that meets the needs of executives, the shareholder family, and the distinct requirements of each business unit.

This integrated governance approach ensures Votorantim’s sustained growth and resilience.

1. Ownership

The board of Hejoassu, composed of 12 family shareholders, is responsible for conveying the family’s macro vision, financial aspirations, and risk appetite to the organization. It acts as the guardian of Votorantim’s culture and DNA, appointing members to the board of Directors of Votorantim, the investment holding company, and ensuring alignment with the family’s purpose and long-term objectives.

The family proactively maintains its vision for the business through organized governance, striving to collectively understand challenges, and ensuring that Votorantim continues to develop sustainably. This vision, refined through extensive dialogue, makes clear the shareholders’ intentions and informs the company’s strategy based on the current landscape.

2. Family

The Family Board is responsible for the educational and development initiatives that prepare the next generation of responsible shareholders. It promotes transparency, unity, and the preservation of the Votorantim legacy. Over the past decades, the company’s sound succession planning has been fundamental to its resilience.

“As the family representatives in Votorantim’s governance structure, our challenge is to preserve our century-old legacy as an inspiration for the future, contributing to the development of the next generation of shareholders and the transition of generations, ensuring unity and business longevity.”

– Luciana Domit, Chairman of the Family Board

The Family Board seeks to uphold Votorantim’s reputation by getting involved and thoroughly understanding the businesses to safeguard the company’s long-term interests.

3. Business

At the holding company level, the Board of Directors is composed of seven members, four of whom are independent, including the Chairman. Its key responsibilities include defining action plans, capital allocation, appointing executives and board members of the portfolio companies, and monitoring their performance.

Both independent directors and shareholder family representatives share the primary objective of ensuring the company’s long-term sustainability, regardless of potential short-term pressures. This requires communication and alignment, not only at the decision-making and executive levels but with all stakeholders involved.

Meanwhile, the Management Team, composed of the CEO and Executive Directors, is responsible for running the business in accordance with the guidelines set by the board.

“At Votorantim, we have a clear and defined mandate that is always developed jointly with the Board and shareholders. This mandate determines our strategic objectives, the level of risk we are willing to undertake, and the tools and incentives management has at its disposal. Clear communication of these instruments in a smooth and frictionless manner ensures that the balance between long- and short-term objectives, risk and growth, and management and governance become an inseparable part of the company’s DNA and corporate culture. Ultimately, the goal is to make these balances ingrained in the company’s culture, beyond written and well-communicated policies.”

– João Schmidt, CEO of Votorantim

Votorantim’s operations are guided by three fundamental policies, which play an essential role in long-term capital allocation and business strategy:

- The Investment Policy defines the parameters for meeting shareholder investment objectives, ensuring a balanced combination of assets that promote long-term capital preservation and growth. It emphasizes measurement, monitoring, and risk management.

- The Dividend Policy establishes clear rules for distributing dividends to shareholders.

- The Financial Policy determines the company’s appetite for risk by setting guidelines for managing liquidity and debt.

Management’s mandate is to achieve the shareholders’ investment objectives through initiatives guided by Votorantim’s DNA and compliance with these policies. The Investment Policy seeks to ensure a balanced combination of assets with long-term capital preservation and growth characteristics. In unison with the Dividend Policy and Financial Policy, it ensures Votorantim’s financial health, the clarity of the company’s investment objectives, as well as shareholder returns.”

Long-term thinking, lasting businesses

To ensure the success and longevity of a company, shareholders, Board members, and Management must share a deep conviction in the adopted strategy, resisting the distractions of immediate results or short-term fluctuations. Building trust is essential to enable bold and often countercyclical decisions, especially in times of volatility. These decisions must be guided by confidence that they align with the company’s long-term vision.

Sustaining and revitalizing this strategy requires continuous education and open communication among stakeholders. Regularly revisiting the rationale behind strategic choices reinforces commitment, ensures alignment, and builds confidence in executing the strategy effectively.

As a family-owned business, Votorantim must plan for the next 100 years.

Votorantim operated as an industrial conglomerate until 2014 when it began its transformation into an investment holding company. This shift required a complete redefinition of the roles of its Boards and executives.

Votorantim Industrial, as it was formerly known, operated as a holding that complemented business operations but lacked the ability to operate at a portfolio level or establish a long-term capital allocation strategy. The primary focus was on optimizing existing companies, which did not fully align with the shareholders’ vision of building a diversified and enduring portfolio. Today, the long-term strategy is designed at the holding level, integrating the objectives and priorities of all companies within a broader plan for expansion, diversification, and business resilience.

Votorantim’s transformation necessitated changes in its governance approach to align new strategies, growth appetites, and the evolving relationship between board members and executive management. While the legacy Boards and executives mostly focused on the individual companies’ operational strategies, the new model calls for a broader perspective and an ownership mindset. This transformation involved decentralizing the portfolio companies and empowering the holding to operate as a strategic management and capital allocation entity. This required hiring and preparing executives who could think at a portfolio level, manage risk, and operate in alignment with the family’s long-term strategic objectives.

This business model shift was also followed by a seamless transition between generations of family shareholders on the Board of Directors. The fifth generation holds deep pride in the company and respect for its legacy.

Building a Governance Model Tailored to Succeed

Votorantim’s transition model embraces a long-term horizon, involving approximately 20 years of exposure to the business, active preparation, and engagement with previous generations before successors assume their Board roles. This process has been enriched by combining best practices from external case studies with internal reflection. The company understands that each business has its specific organizational complexities—whether due to its operational model, shareholder base, or controlling family. Therefore, no off-the-shelf model works without some measure of adaptation.

Votorantim’s experience demonstrates that a successful generational transition requires transparent processes, clear communication, well-defined evaluation criteria, and effective expectation mapping. This ensures a legitimate, meritocratic process that focuses on the company’s best interests. The transition introduces fresh energy and perspectives without losing sight of the family’s purpose and long-term objectives. Family members new to the Board bring renewed enthusiasm, contributing experiences and insights that enhance management practices.

This discipline in succession planning is reflected in capital allocation decisions. It has enabled Votorantim to remain the only Brazilian private company rated investment-grade by the world’s three leading credit rating agencies.

For other companies aiming to future-proof their Boards, the first step is to define what long-term vision means in their context and to make that concept tangible. Without clear, guiding parameters, it is challenging to maintain focus on long-term objectives, leaving the company susceptible to short-term pressures. The second step is to identify scenarios that require adjustments. Long-term strategies are not rigid; they must strike a balance between the demands of a changing world and the preservation of the business’s core vision and desired destination.