Sustainability metrics: why it's time investors look in the mirror

How can investors assess their funds and portfolios through non-traditional or stakeholder metrics? Image: Daniel DiFranco/Pixabay

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

ESG

- Investors look for sustainability and non-traditional metrics from companies they invest in, but what if they held themselves accountable in the same way?

- Focusing the sustainability lens inward will allow the fund to better anticipate and adapt to new risks and opportunities in the years ahead.

- From people and planet to governance, there are four crucial areas that investors can analyse to give a clearer view of the sustainability profile of their capital.

This piece is from a blog series written by members of the Global Future Council on Investing exploring factors shaping the investment portfolio of 2040.

You can further explore the themes discussed in this article by reading our community paper.

In recent years, investor demand for “non-traditional” or “stakeholder” metrics has led companies to the disclosure of a wealth of new information beyond traditional accounting statements. Investor and corporate communities increasingly agree that long-term performance and stakeholder strategies are intertwined.

How companies manage their people, use the planet’s resources and affect the communities around them all factor into their success in the long run. “What gets measured gets managed,” says the old adage and the corporate world is moving towards measuring what matters

Today, investors are typically the users rather than producers of this non-traditional information. Most institutional investors seek information on sustainability issues to better assess companies’ adaptability and resilience and monitor their risk management to inform investment decision-making and votes. Investors want to get to the core of what really drives businesses over time.

This begs the question: shouldn’t investors be looking at the same issues in their own organizations and portfolios? Couldn’t investors benefit from a similar evaluation?

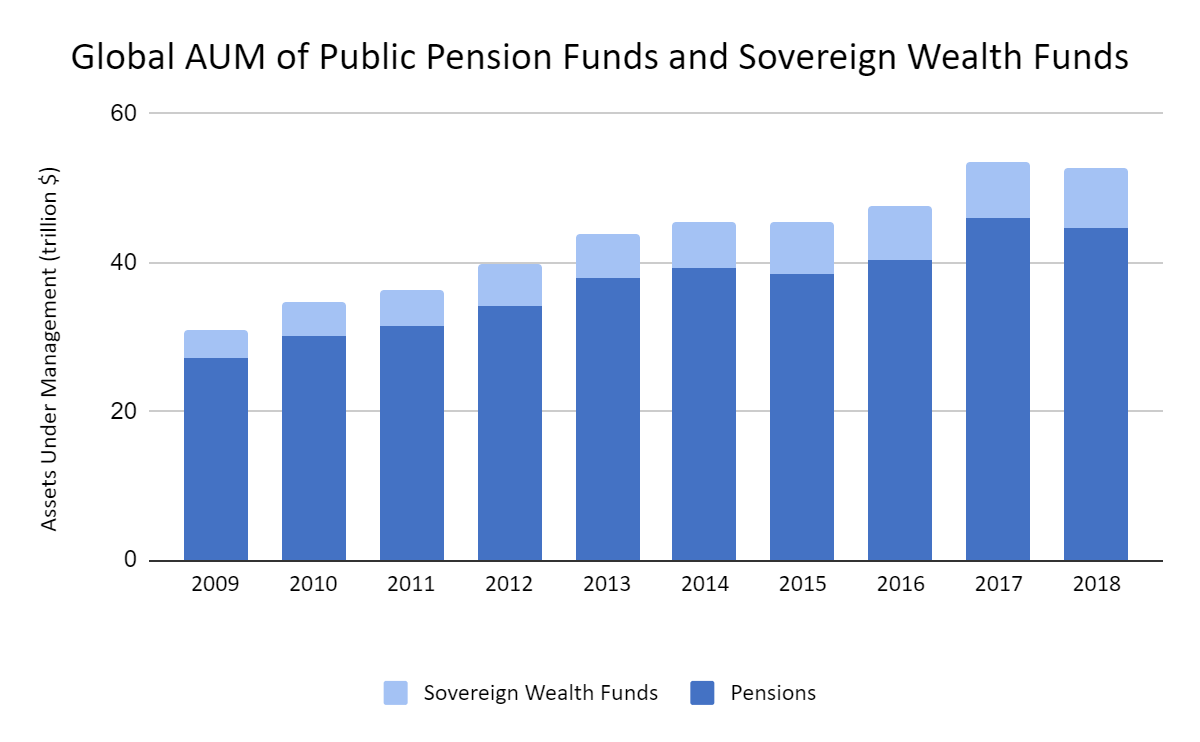

While investors are looking for sustainability and other non-traditional metrics from the companies in which they invest, leading asset owners are increasingly recognizing that the benefits of similar accountability. Focusing the sustainability lens inward will allow the fund to better anticipate and adapt to new risks and opportunities in the years ahead. The potential impact is massive: our analysis shows that on a global level, assets under management from public pension funds and sovereign wealth funds alone have grown from $31 trillion to $53 trillion between 2009 and 2018. In such a large and growing space, investor sustainability metrics become critical.

For those asset owners that have yet to assess their own sustainability practices, measuring several critical focus areas will be a significant first step. Doing so can provide a core set of analyses that could be included alongside more traditional investment reporting and give investment committees, boards and, in some cases, beneficiaries a clearer view of the sustainability profile of their capital. Organized around the World Economic Forum’s four categories of company metrics and drawing from metrics and standards organizations (such as GRI, SASB and TCFD) as well as FCLTGlobal’s work, here are some examples of metrics and disclosures that are relevant for an asset owner and its portfolio:

- Principles of governance: Starting with the purpose and the investment timeline of the fund is critical, but many investors lose track of these overall goals. A reminder that starting there can help an investor maintain that long-term focus over time. Clarity on engagement with companies – how investors actively engage with the managers/companies in which they invest on an ongoing basis to make sure they’re serving all stakeholders – will also aid this.

- Planet: Making clear commitments to both net-zero portfolios and the pathway to get there is critical for asset owners. Many investors also own substantial real estate assets directly, so considering biodiversity issues in that portfolio is important. Finally, recognizing how the portfolio is allocated among assets that integrate ESG factors, are sustainability-themed or screened or invested for impact provides an overall picture of a portfolio’s sustainability profile;

- People: Large asset owners are organizations in their own right, not just portfolios. Consideration of the diversity and inclusion, pay equity and compensation principles of the asset owner matters for investors as it does for companies;

- Prosperity: The success of a fund against its stated purpose over the relevant timeframe is the ultimate measure of success for an asset owner. One way to reach superior long-term performance is to consider the percentage of assets that have investment mandates or contracts which feature long-term success and driving engagement with the companies owned.

Investors’ desire for new metrics is undeniable. Now, we are seeing leading asset owners turning that demand inward to help themselves better anticipate emerging risks and opportunities. By focusing on these four crucial areas, asset owners can incorporate forward-looking information into a thoughtful look at themselves – better equipping them to deliver sustainable returns during the investment timeline that are aligned with their purpose.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on ESGSee all

Robin Pomeroy and Sophia Akram

April 10, 2024

Chavalit Frederick Tsao

March 27, 2024

Claire Skinner

November 28, 2023

Patrick Henry and Madeleine North

November 22, 2023

Cintia Nunes

September 14, 2023